Medicare tax calculation 2023

The standard Medicare Part B premium is 17010month in 2022. Start the TAXstimator Then select your IRS Tax Return Filing Status.

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

FICA taxes include both the Social Security Administration tax rate of.

. New Medicare Plus Vendor. UnitedHealthcare UHC will provide coverage for Medicare Plus beginning January 1 2023. The Medicare tax rate is 29 of your income.

2023005 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2022 tax return and tax refund calculations. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. If youre single and filed an individual tax return or married and filed a joint tax return the following.

Tax Planning Consideration for IRMAA 2023. If you work for an employer you pay half of it and your employer pays the other half 145 of your wages each. This calculator is integrated with a W-4 Form Tax withholding feature.

Social Security and Medicare Withholding Rates The current tax rate for social security is 62 for the employer and 62 for the. What is a 202301k after tax. The Additional Medicare Tax.

Different rates apply for these taxes. 26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA. For CY 2023 CMS is finalizing a coding pattern adjustment of 59 which is the minimum adjustment for coding pattern differences required by statute.

Calculate Your 2023 Tax Refund. The table below details how Federal Income Tax is calculated in 2022. For example based on the 2022 income chart if you filed individually and your 2020 MAGI was over 91000 but no more than 114000 or if you filed as a married couple.

The standard Part B premium for 2022 is 17010. So before 65 if you want premium ACA. You may get a reduction or exemption from paying the Medicare levy depending on.

The Medicare tax rate is 145. The FICA portion funds Social Security which provides. In case you got any Tax Questions.

Monthly Medicare Premiums for 2022. The Medicare levy is 2 of your taxable income in addition to the tax you pay on your taxable income. But the Federal Insurance Contributions Act tax combines two rates.

A 40 surcharge on the Medicare Part B premium is about 800year per person or about. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. 2021 Tax Calculator Exit.

Based on the Information you entered on this 2021 Tax Calculator you. Members currently enrolled in Medicare Plus must. The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and Thresholds as.

Contact a Taxpert before during or after you prepare and e-File your Returns. Still only the taxable portion of social security is added back on the MAGI calculation for Medicare.

Federal Register Medicare Program Hospital Outpatient Prospective Payment And Ambulatory Surgical Center Payment Systems And Quality Reporting Programs Organ Acquisition Rural Emergency Hospitals Payment Policies Conditions Of Participation

Federal Register Medicare Program Hospital Outpatient Prospective Payment And Ambulatory Surgical Center Payment Systems And Quality Reporting Programs Organ Acquisition Rural Emergency Hospitals Payment Policies Conditions Of Participation

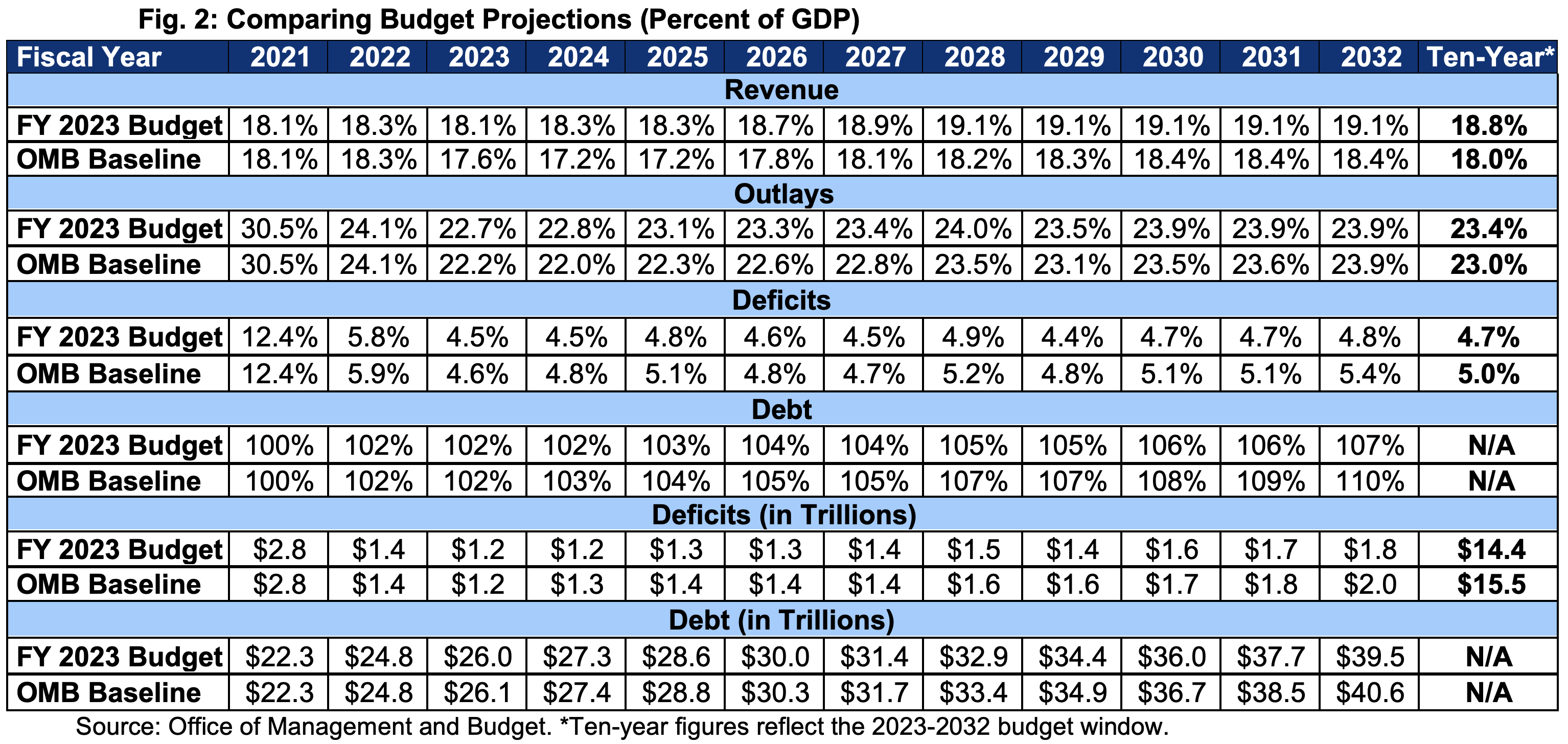

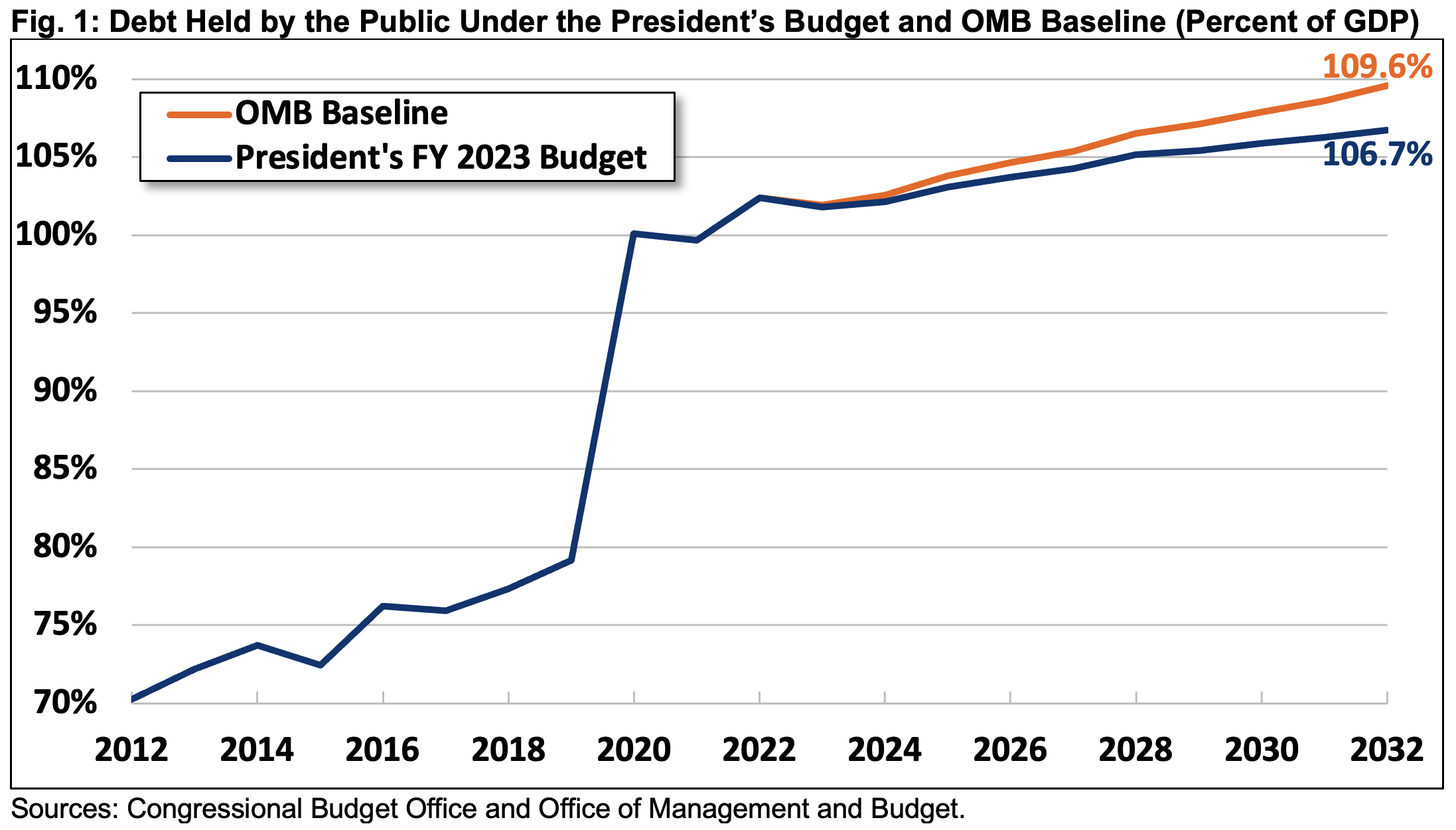

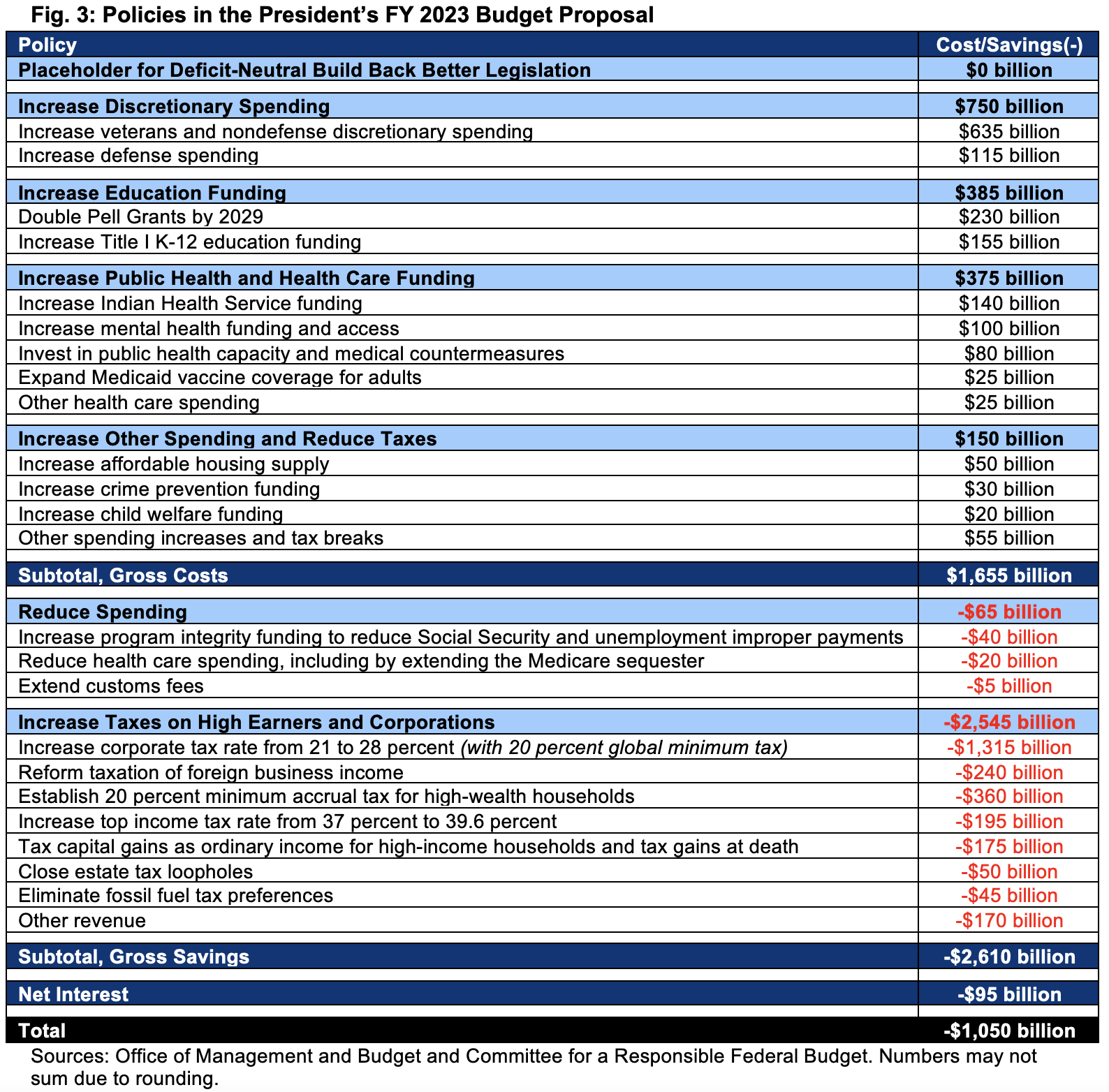

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Icd 10 Cm 2023 The Complete Official Codebook With Guidelines Icd 10 Cm The Complete Official Codebook 9781640162228 Medicine Health Science Books Amazon Com

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Federal Register Medicare Program Hospital Outpatient Prospective Payment And Ambulatory Surgical Center Payment Systems And Quality Reporting Programs Organ Acquisition Rural Emergency Hospitals Payment Policies Conditions Of Participation

Federal Register Medicare Program Hospital Outpatient Prospective Payment And Ambulatory Surgical Center Payment Systems And Quality Reporting Programs Organ Acquisition Rural Emergency Hospitals Payment Policies Conditions Of Participation

Federal Register Medicare Program Hospital Outpatient Prospective Payment And Ambulatory Surgical Center Payment Systems And Quality Reporting Programs Organ Acquisition Rural Emergency Hospitals Payment Policies Conditions Of Participation

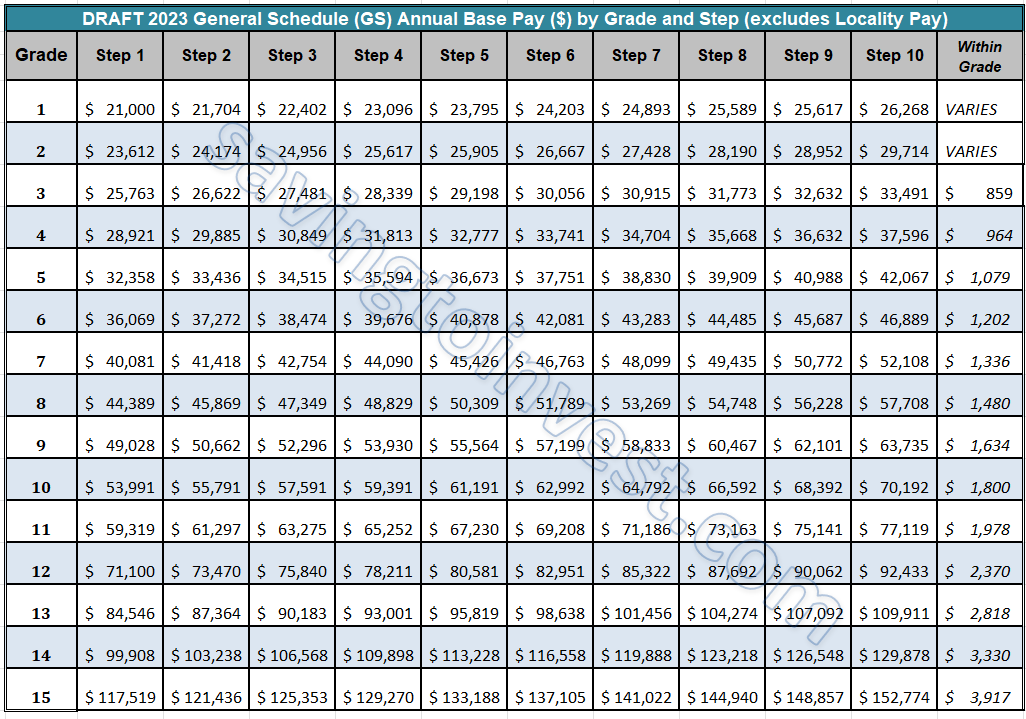

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

Maximizing Your Advanced Practice Workforce Through Implementation Of Cms 2023 Mpfs Split Shared Rule

Could 2023 Social Security Cola Hit 9 Benefitspro

Could 2023 Social Security Cola Hit 9 Benefitspro

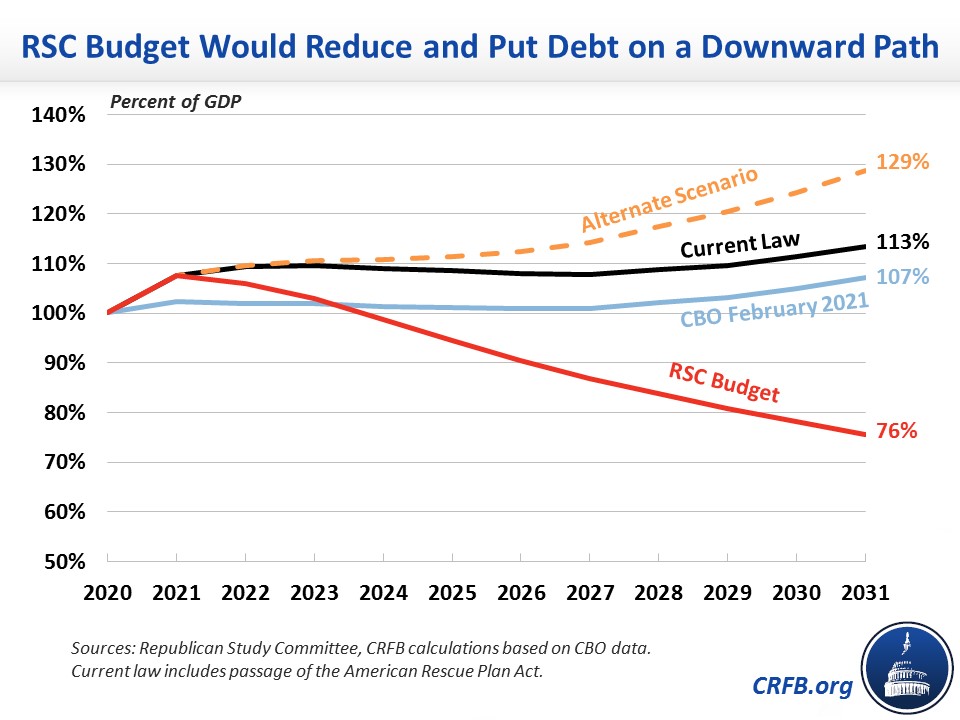

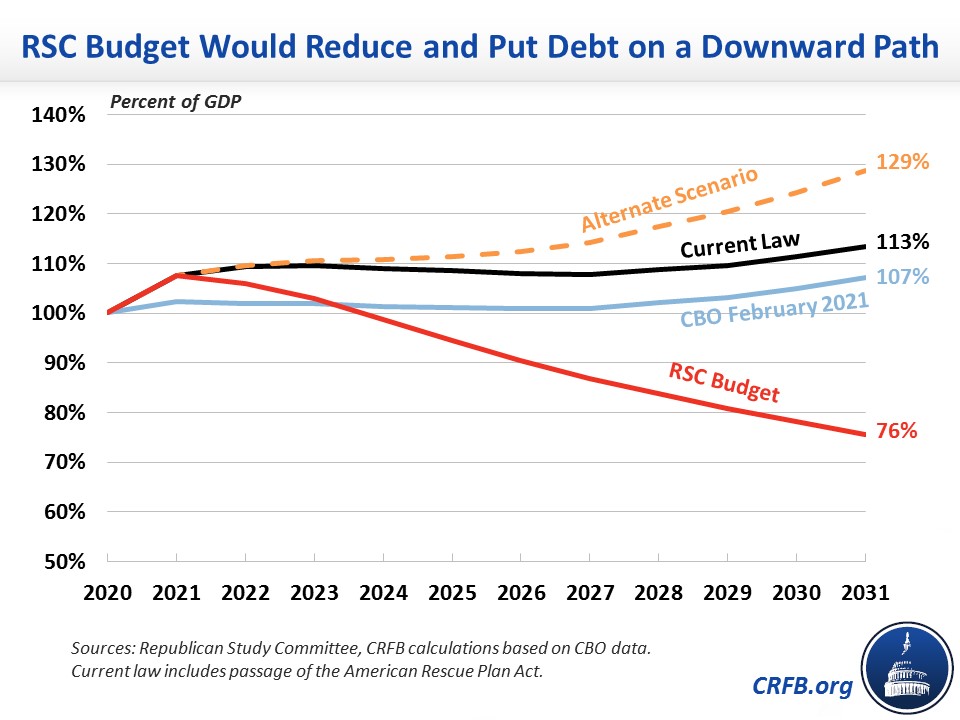

Rsc Releases Its Fy 2022 Budget Proposal Committee For A Responsible Federal Budget

Federal Register Medicare Program Hospital Outpatient Prospective Payment And Ambulatory Surgical Center Payment Systems And Quality Reporting Programs Organ Acquisition Rural Emergency Hospitals Payment Policies Conditions Of Participation

Icd 10 Cm 2023 The Complete Official Codebook With Guidelines Icd 10 Cm The Complete Official Codebook 9781640162228 Medicine Health Science Books Amazon Com

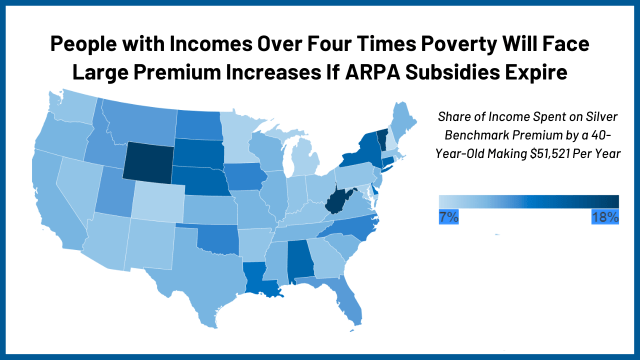

Falling Off The Subsidy Cliff How Aca Premiums Would Change For People Losing Rescue Plan Subsidies Kff